Peg ratio formula

A stock with a PEG ratio lower than 1 is cheap relative to its earnings growth but a number much higher than 1 implies that the stock is expensive. Its not risky but it is also not very safe.

Peg Ratio Formula How To Calculate Price Earnings To Growth

Solvency ratio is one of the quantitative measures used in finance for judging the company financial health over a long period of time.

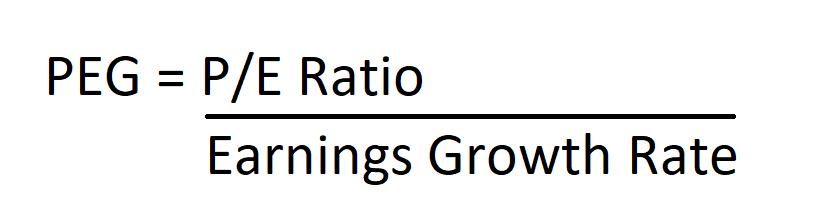

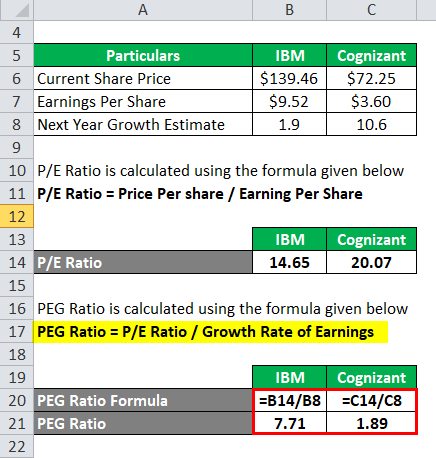

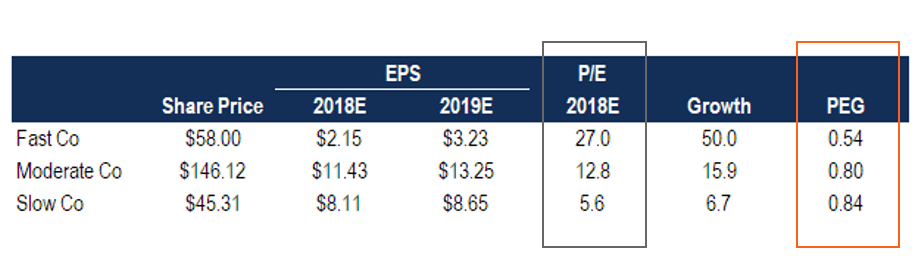

. Firstly the daily rate of return of the concerned portfolio is collected over a substantial period of time ie. The term PEG ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth. However there are drawbacks to using.

In contrast market capitalization is determined based on the. The PEG ratio can be calculated in different ways. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable.

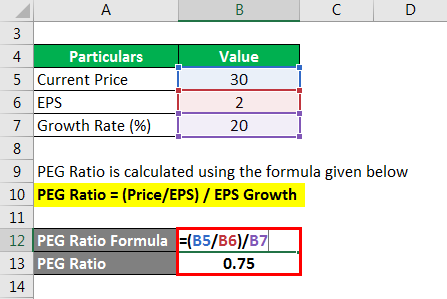

Book to Market Ratio Book To Market Ratio The book to Market ratio compares the book value of equity with the market capitalization where the book value is the accounting value of shareholders equity. From here the formula for the PEG ratio. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

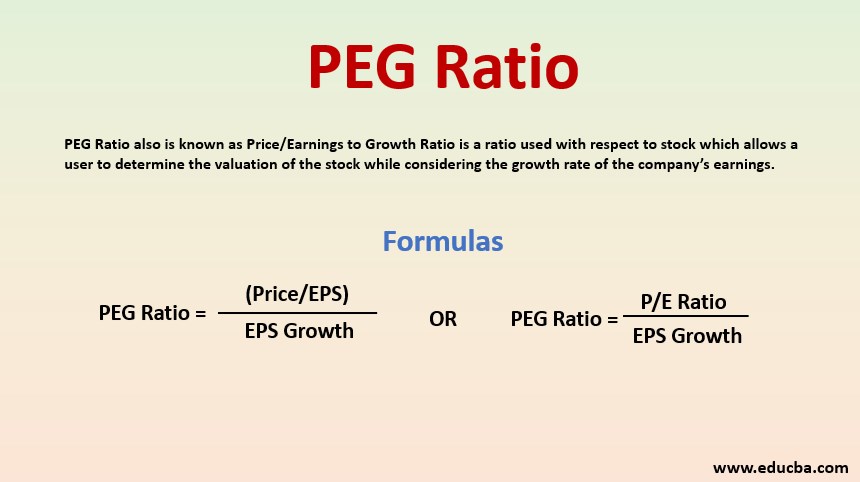

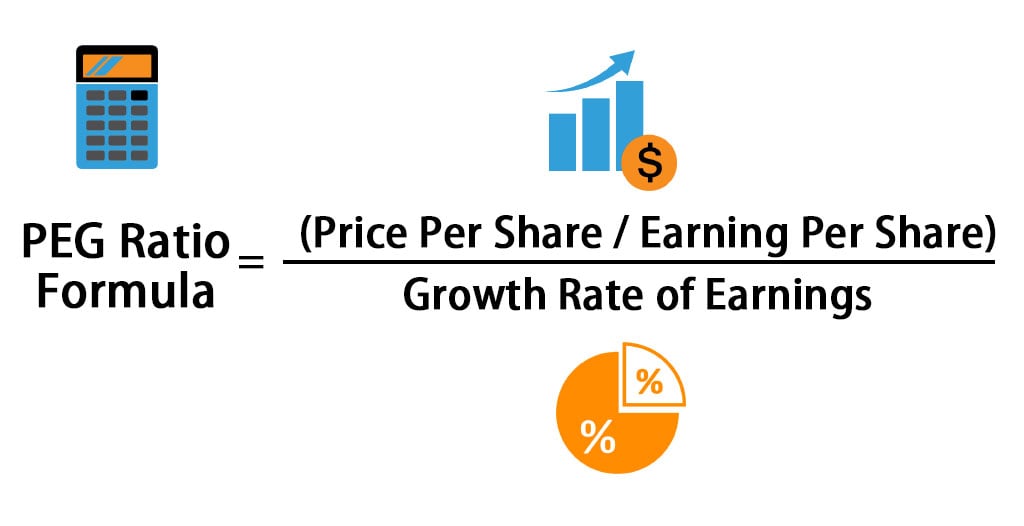

Cash Flow Coverage Ratio Operating Cash Flows Total Debt. Read more or PriceEarnings to Growth ratio refers to the stock valuation method based on the. PriceEarnings To Growth - PEG Ratio.

A trailing PEG ratio uses the. Learn what a good PEG ratio is. The PEG ratio is a good way to value a stock while taking its growth rate into account and investors should be familiar with how the PEG ratio formula works.

Building a Discounted Cash Flow DCF model typically takes into account about 5 years of forecasted growth plus a terminal value to arrive at the net present. A PEG ratio greater than 10 indicates that a stock is overvalued. A ratio of 1 is usually considered the middle ground.

Using the PEG ratio formula can be useful but ultimately financial modeling is the best way to account for all aspects of a companys growth profile when performing a valuation. Explanation of the Sharpe Ratio Formula. Thus using just the PE ratio would make high-growth companies appear overvalued relative to others.

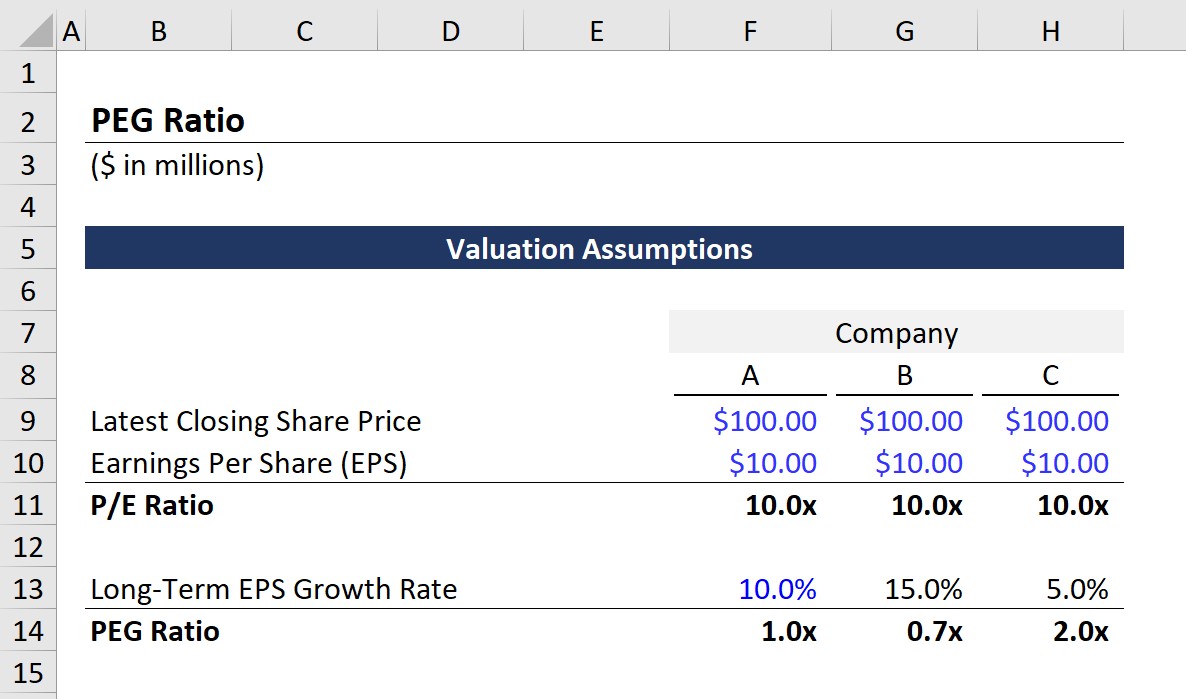

The priceearnings to growth ratio PEG ratio is a stocks price-to-earnings PE ratio divided by the growth rate of its earnings for a specified time. A PEG ratio greater than 10 indicates that a stock is overvalued. The priceearnings to growth PEG ratio is a stock valuation measure that provides a sense of a companys performance.

The formula for the Sharpe ratio can be computed by using the following steps. What is PEG Ratio Formula. The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share and the companys expected growth.

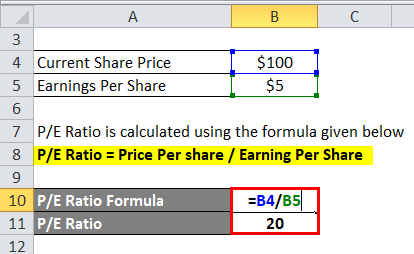

In general the PE ratio is higher for a company with a higher growth rate. As an example a stock with a PE ratio of 20 but is growing earnings at 20 per year will have a PEG ratio of 1. A WCR of 1 indicates the current assets equal current liabilities.

The rate of return is calculated based on net asset value at the beginning of the period and at the end of the period. Solvency Ratio 32500 5000 54500 43000 Solvency Ratio 38 Explanation of Solvency Ratio Formula. There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included.

A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows.

Peg Ratio Example Explanation With Excel Template

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Breaking Down Finance

Peg Ratio Example Explanation With Excel Template

What Is The Peg Ratio

Peg Ratio Definition Equation Calculation

Peg Ratio Definition Formula Seeking Alpha

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Peg Ratio Formula How To Calculate Price Earnings To Growth

What Is Peg Ratio Quora

Peg Ratio Vs Price To Earnings P E Ratio Youtube

Peg Ratio Price Earnings Growth Ratio What It Really Means

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

What Is Peg Ratio Yadnya Investment Academy

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template